Brooklyn Mirage Bankruptcy: When the Trustee Gets Paid First

Inside Avant Gardner's Chapter 11 liquidating trust, Joshua Nahas collects $15K/mo while unsecured creditors wait years for recovery. What happened to "for the benefit of creditors"?

words by Nina K.Malik

Brooklyn Mirage. Mayan Warrior May 2024. Photo by Erik Lorch

When the Liquidating Trust was sold as a vehicle “for the benefit of creditors,” the headline concessions all pointed in the same noble direction: Axar funds the wind-down, steps back from a huge deficiency claim, and the estate gets a clean, orderly process instead of a bonfire of competing lawsuits. On paper, everyone moves toward closure.

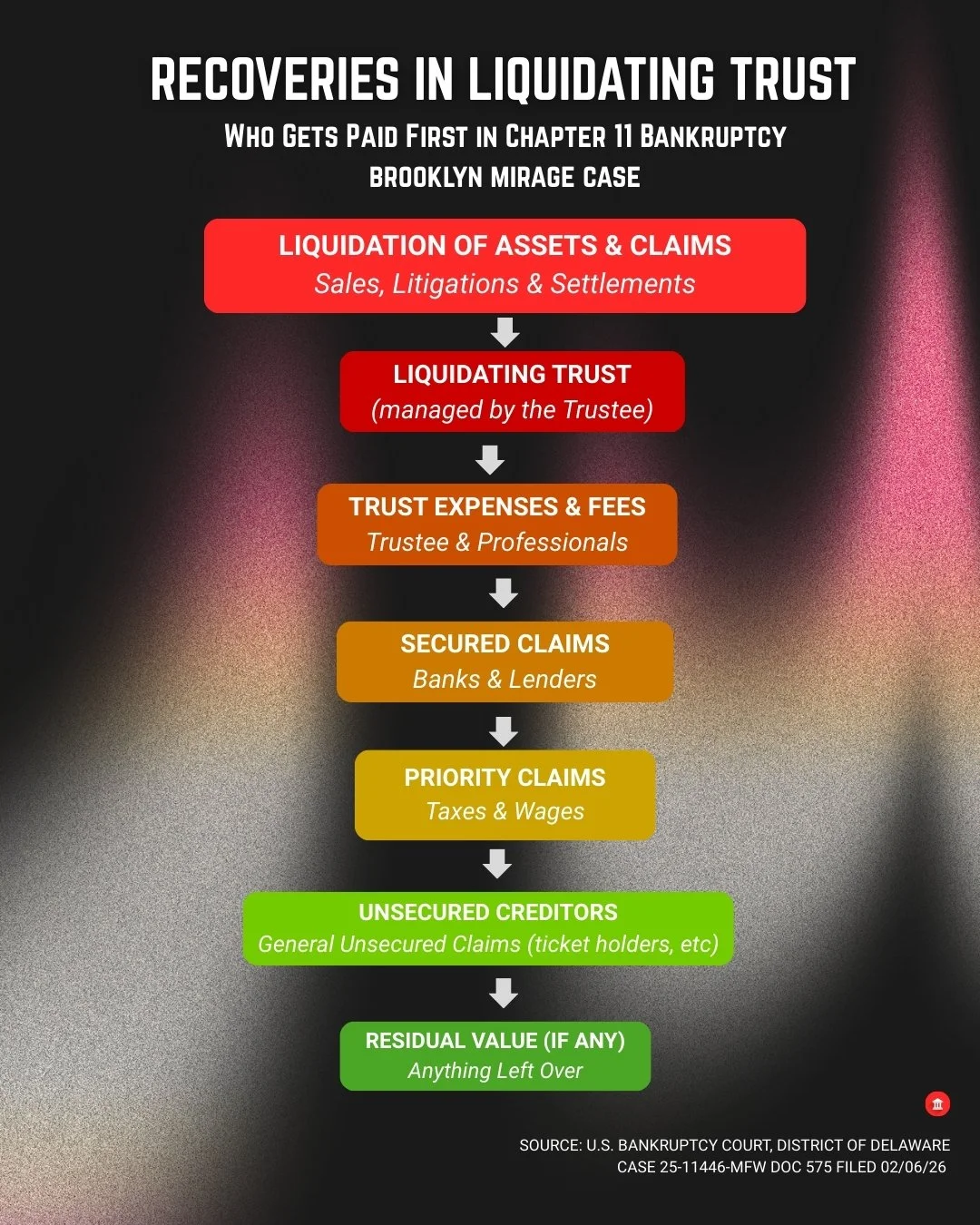

Brooklyn Mirage Chapter 11: Recoveries in Liquidating Trust.

source: U.S. Bankruptcy Court, District of Delaware. Case 25-11446-MFW Doc 575 Filed 02/06/26

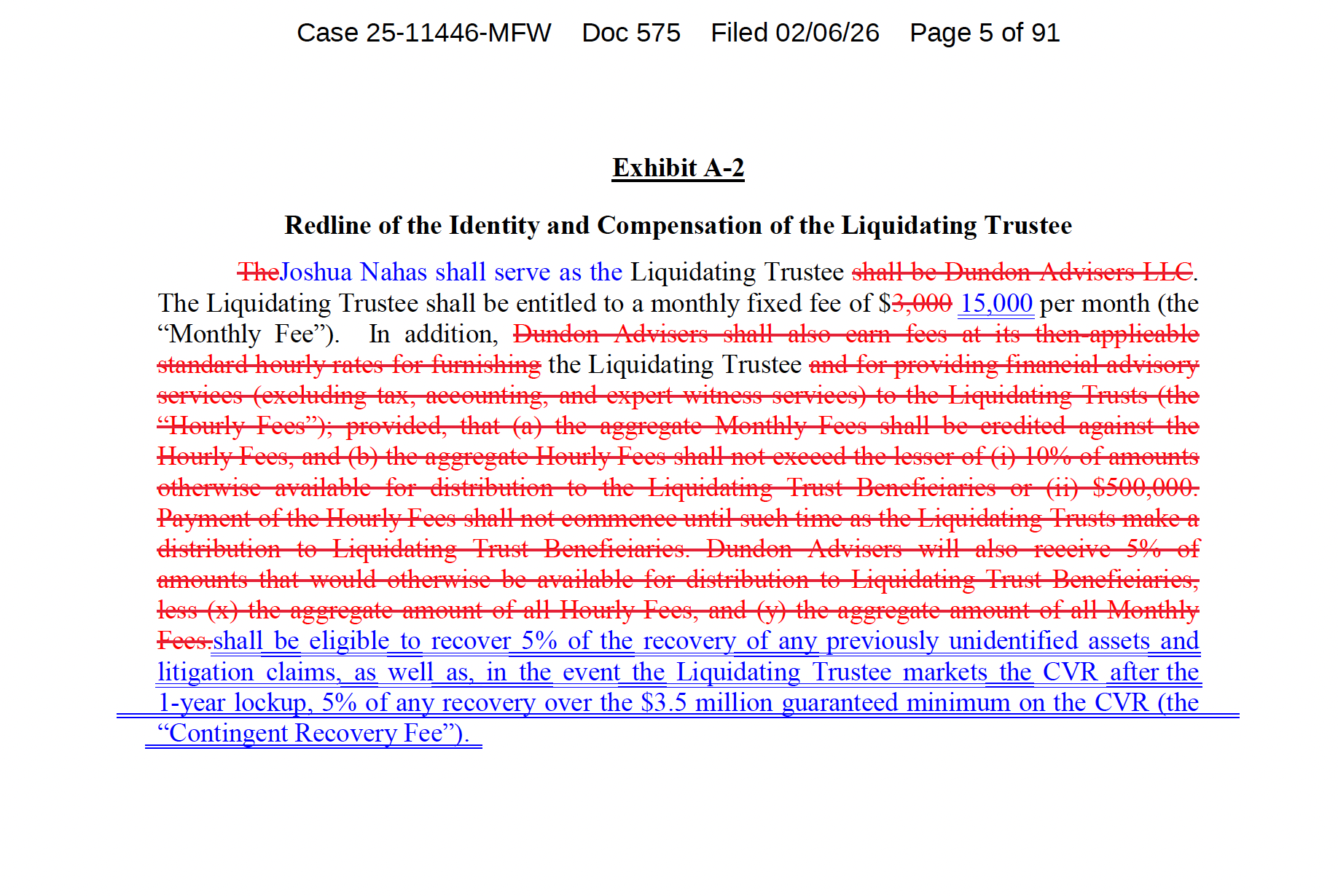

Inside the trust documents, though, an interesting deal takes shape. According to the confirmed plan and Liquidating Trust Agreement filed at Docket 575 in Case 25-11446-MFW, the Liquidating Trustee’s fixed fee doesn’t just tick up—it jumps from a token $3,000 a month to a $15,000 monthly retainer, on top of hourly billing and contingent upside tied to new recoveries. The person who controls which claims live or die, when to settle, and how aggressively to litigate is now one of the most expensive fixed costs in a structure ostensibly built to get as much money as possible back to unpaid creditors.

Joshua Nahas: Bankruptcy Veteran, $15K/Month Trustee

Joshua Nahas, CIRA (25+ years), ex-distressed debt PM, creditor committee veteran (Caesars, Lehman, PG&E). Now Brooklyn Mirage Liquidating Trustee—collecting $15K/month while controlling all claims.

Those same documents make Joshua Nahas of Dundon Advisers LLC, as Liquidating Trustee, the single most powerful actor in the estate’s afterlife—paid first, indemnified heavily, and armed with broad discretion over which claims to pursue or drop. Perfectly legal. The question: are unsecured creditors effectively represented, or just nominally protected?

The Global Settlement's "Remarkable" Numbers

The court called the Global Settlement (D.I. 372) "remarkable" for creditors: $1.05M upfront plus $750K annually for three years. Whether those fixed payments survive as Nahas's $15K/month tabs accumulate—along with hourly fees and contingency percentages—remains the structural tension at the heart of this trust.

From the outside, it is hard not to read the incentives a certain way. On one level, the justification is standard: complex post-confirmation litigation needs a seasoned professional. You pay for experience and for someone willing to sit in the blast radius of angry creditors, opportunistic defendants, and years of procedural grind. A higher retainer, plus upside, is framed as the price of getting a serious player to take the keys.

Axar's Insurance Policy?

But look at the incentives from Axar’s side of the table. As the buyer and settlement counterparty, Axar’s interest is in locking in its bargain and containing litigation risk around the deal, the CVR, and any residual claims that might claw back value it thinks it has already paid for. A trustee who is well-compensated, heavily indemnified, and armed with “absolute discretion” over which causes of action to pursue can function as a stabilizer: someone who will weigh risk, optics, and timing in a way that won’t casually blow up a global settlement. If you assume that’s part of the job, $15,000 a month isn’t an indulgence; it’s insurance.

Exhibit A-2. source: U.S. Bankruptcy Court, District of Delaware. Case 25-11446-MFW Doc 575 Filed 02/06/26

From the creditors’ side, the math looks harsher. Every month the case drags on, the first $15,000 comes off the top before a single dollar flows to vendors, ex-employees, contractors, or artists still owed money from the venue’s pre-petition days. Layer in hourly fees and contingency percentages and the trust begins to resemble a funnel: litigation proceeds at one end, professional overhead in the middle, partial recoveries dribbling out the other side. The risk is that the trustee, consciously or not, becomes more of a risk manager for Axar’s settlement than a relentless maximizer for unsecured creditors.

No filing openly says, “this trustee will protect Axar.” The documents speak in neutral terms: fiduciary duty, best interests of the trust, maximization of net recoveries. Yet the structure hints at something more. A generously priced, heavily insulated trustee with broad power over what gets litigated, what gets dropped, and how much gets disclosed is profoundly useful to the new owner who wants predictable enforcement of a delicate deal. For the people at the bottom of the waterfall, it can feel like paying for somebody else’s peace of mind.

Before moving forward..let’s rewind here and talk about:

Axar Capital's Investment Timeline

Axar Capital Management slithered into Avant Gardner’s picture in late 2023, dangling a senior secured term loan that started at $121 million and ballooned to $143.6 million (plus $20-22.6 million in so-called “protective advances” by 2025) to bankroll Brooklyn Mirage renovations, even as the venue was already flashing distress signals—the 2023 Electric Zoo clusterfuck, DOB side-eye, you name it. DOB-now Records confirm the Temporary Certificate of Occupancy (TCO) was secured on April 28, 2025 (per DOB document OCO-073885), and revoked May 1, 2025 after failing final safety inspection hours before the planned Sara Landry reopening. Construction permits were placed "on hold" April 30-May 1, sealing the shutdown. Come June 2025, Axar’s Andrew Axelrod stepped in to push stalled replacements—a clear sign they were taking control as Avant Gardner burned millions on unpermitted work, all while dangling empty promises of a 2026 reopening and brazenly continuing to sell tickets for phantom shows. And then, boom—catastrophic implosion, Chapter 11 filing that August (first as AGDP Holding, then Case 25-11446 in Delaware) with $155.3 million in secured debt hanging like a noose, $11.9 million of it junior to LiveStyle Inc.

Lender Control and Asset Flip

Axar tossed $45.8 million in DIP financing to keep the lights on and run the asset fire sale, snagging court OK for their $110 million credit bid through affiliate AG Acquisition 1 LLC on October 22—creditors howling about financial fibs be damned, handing Axar the keys to Mirage’s demo/rebuild while eating their loan losses. Merchant cash advance sharks, those high-interest hustlers who shoveled bridge cash into the cratering operation, slapped Axar with a suit right after (Bloomberg Law sniffed it first), claiming the big lender straight-up lied about Avant Gardner’s books, buried DOB fuckups and construction red flags during 2024-early ’25 extensions, and lowballed liquidity doom post-revocation to lure in MCA millions that bankruptcy waterfalls flushed away. They wanted the sale ripped up or transfers yanked back, citing Axar’s board puppets (Gary Richards, Hooman Yazhari), but Judge Mary F. Walrath greenlit it anyway with a “remarkable settlement” that tossed unsecureds a bone; more creditor bitching later, and Axar flipped the whole mess by early January 2026 to Dubai’s FIVE Holdings (Pacha’s sugar daddy) post-Feb. settlements—independent nightlife jewel reborn as “Pacha New York” come summer, private equity’s distress-to-chain flip in all its gory glory.

The Judge's Threshold

The judge’s role sits in the background of all this. The plan, the trust, and the fee framework have already been confirmed as proposed in “good faith” and in the “best interests” of the estate. Courts routinely approve negotiated fee structures in complex reorganizations; this case is not an outlier so much as an unusually visible example. That doesn’t mean the court endorsed every future exercise of the trustee’s discretion; it means, given the record and the options on the table, this package cleared the threshold for approval. Whether that calculus still looks acceptable as monthly retainers stack up and unsecured recoveries thin out is a question that usually surfaces only if someone has the money and appetite to challenge fees later.

Unmixed has reached out to Gary Richards, CEO of Avant Gardner and public face of Brooklyn Mirage, for comment on the liquidating trust structure, the trustee compensation terms, and what this means for unsecured creditors still awaiting recovery. No response was received by press time.

For now, what you can say with certainty is this: a trust that exists, in theory, to pay creditors has elevated the person in charge of that mission into one of its primary beneficiaries. The open question—what this piece leaves hanging—is whether that is a necessary cost of order in a broken system, or proof that in Chapter 11, the people doing the cleaning always get paid before the people left holding the bill.